Since they are unable to get a handle on their financial situation, a significant number of individuals need help meeting their basic needs. The fact that they have to pay late payment penalties in addition to the already high monthly cost of their bills is one of the primary contributors to this problem. Rocket Money is a legitimate app for managing your finances; it was initially known as Truebill.

Rocket Businesses own Truebill. You can cut costs with the assistance of Truebill by adhering to a spending plan, negotiating with your utility companies for reduced rates, and canceling unused subscriptions. Since it is one of the most significant applications now available to help individuals save money in various ways, the cost of the app (which starts at $3 per month) may be justified.

It may be a highly time-consuming and mentally demanding process to search through all of your bank accounts for unused subscriptions so that you can cancel them. Truebill (which was once known as Truebill), on the other hand, aims to alleviate some of that inconvenience. It is an app and an internet platform that connects to your various accounts and searches for subscriptions you have been paying without your knowledge.

In addition, the app provides a bill negotiating tool, enabling users to reduce the monthly expenses of the goods they must pay for. If you’re interested in giving the Truebill app a try and want to learn more about it, Select has outlined everything you need to know about it below, including a rundown of the app’s features, instructions on how to get started using it, and a few other pertinent details.

What is Truebill?

The Rocket Companies’ fintech platform includes a mobile application for personal financial management called Truebill. Until Rocket Companies completed its acquisition of Rocket Money in December 2021, everyone knew the app by its last brand name, Truebill. In August of 2022, Truebill became known as Rocket Money after undergoing a name change.

The primary purpose of Truebill is to teach you how to manage your finances better. You may accomplish this with the app’s various features, such as the ability to terminate undesired subscriptions, set up automatic savings, and negotiate monthly expenses.

To this day, Truebill has assisted more than 3 million users in setting aside over 245 million dollars in savings. It includes terminating undesired subscriptions valued at more than $155 million. You may download the Truebill app from the iTunes Store, Google Play, or the Truebill website.

How to Sign Up for Truebill

The process of signing up for Truebill is straightforward. You must submit your complete name, email address, and password to establish an account. You can also link your account with Facebook to sign in much more quickly.

1. Find your billing service provider

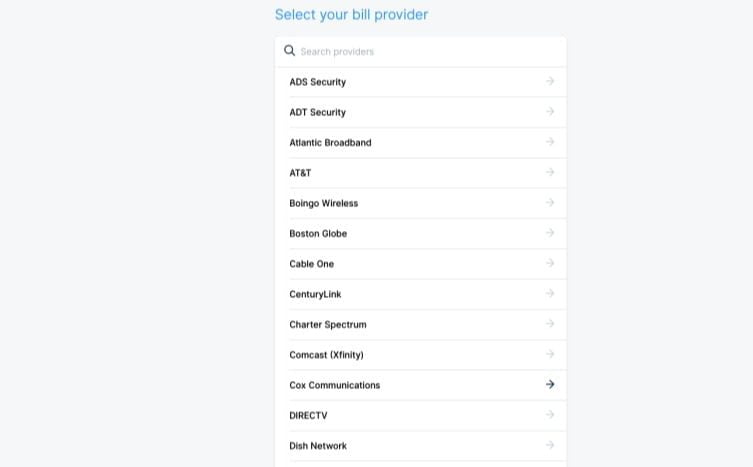

When you have finished setting up your account, you will be invited to look for the billing service that you use. A complete list of well-known corporations, such as Charter, AT&T, and Comcast, is provided here. Regarding successfully negotiating your bills, the app claims to have a success record of 85%.

2. Upload or connect your billing statements

After that, you will be required to provide access to the site to see your monthly billing bills. You can either login into your billing account via the Truebill platform or manually upload a picture or PDF of your invoice. Both of these options are available to you.

3. Provide your phone number

Following that, you will be required to provide your contact number and manually opt into the TrueProtect program offered by Truebills. This software automatically renegotiates your bill if it rises or whenever new offers become available. While TrueProtect is convenient, some Truebill reviews claim that the platform alters different aspects of the user’s mobile phone and cable subscriptions to reduce the user’s monthly costs.

In one of the reviews I’ve seen on Truebill, the customer was upset that the platform had downgraded her mobile subscription and labeled the change “savings.” Even if there aren’t a lot of complaints like this, it’s still essential to think about the ones that do happen. These changes might be troublesome if the platform eliminates channels or services you desire or want.

You must provide your credit card information after inputting your mobile number and selecting to participate in TrueProtect. When you have finished configuring your billing information, the platform will provide you with its functionality for managing subscriptions. They are monitored by Truebill using the statements from your bank or credit card company.

How to use Truebill

Truebill provides its consumers with access to a total of six different significant functions. The following is how they function:

1. Manage your subscriptions

Truebill simplifies keeping track of your subscriptions by displaying them on one screen. It can make it easier to identify subscriptions you are no longer using but are still being paid for. If you subscribe to the Premium plan of Truebill, the service will even cancel any unwanted subscriptions on your behalf. The fact that you won’t have to do it yourself might save you a lot of time and effort.

2. Track your spending

Inside the Truebill app, you can see a comprehensive summary of your financial situation. It involves directly comparing the money you have made and the amount you have spent each month. You can also see the categories that account for most of your expenditures and obtain advice on modifying your spending patterns to boost your savings.

In addition, Truebill can send you real-time warnings about impending charges and when your account balance goes dangerously low. You can prevent late penalties and overdrafts with these notifications regarding the amount in your account.

3. Negotiate your bills

The bill negotiation function will analyze your invoices to identify areas where you can cut costs and save money. It might involve negotiating your cable or mobile phone bill on your behalf to save you time and money and the inconvenience of having to deal with customer care or sales staff on your own.

In addition, Truebill can guide you through obtaining refunds on overdraft and late penalties and offer you the most cost-effective alternatives for auto insurance coverage. Remember that until the bill is successfully negotiated, no fee will be associated with your time spent doing so. Truebill will deduct 40 percent of your funds if it is successful.

4. Automate your savings

The Federal Deposit Insurance Corporation backs the “smart savings” accounts that are available via Truebill. These accounts may automatically transfer funds from the bank account you attach to them to contribute to your savings objectives. This function is excellent for automating your savings process, and it is a practical approach to building up savings without actually thinking about it all that much.

You have complete authority over your account and may make changes, pause, take money from it, or close it anytime. To take some of the uncertainty out of saving money, you can ask Truebill to assist you in analyzing your accounts and advising you when it would be the most incredible time to save money.

5. Track and understand your credit score

Truebill gives you full access to both your credit report and your credit history, and it can keep you informed of any changes to your credit score that occur. The app may also provide insights on future changes to assist you in understanding more about the mathematics that goes into determining your credit score and how your credit history functions.

6. Establish a budget

Truebill examines your transactions and informs you of the monthly money you can spend based on its findings. The program offers a spending breakdown and historical spending trends, which can shed light on areas of your life where you may choose to establish budgeting objectives.

You can choose how much money you wish to spend on “budget categories” such as “entertainment,” “eating & drinks,” or “car & transport” monthly. You can also build custom categories, but unless you upgrade to the Premium plan, you can only have a maximum of two budgeting categories at any time.

Set up real-time notifications with Truebill to alert you, so you don’t overspend on a budgeting objective. It will enable you to manage your finances better and remain within budget.

Truebill Pros

Listed below are the pros of the Truebill app:

- Provides convenience

The majority of reviews for Truebill have complimented the platform on how convenient it is. Subscriptions are relatively easy to cancel if you have subscribed to several services at any time. It is especially true with paid services (e.g., cable companies and gym memberships).

Because it takes so much time to complete, many consumers need help with the chore of canceling their subscriptions. Truebill can assist you in canceling any undesired subscriptions, regardless of how challenging the process may be.

The site provides excellent customer support and contact forms that are simple to complete if you ever find yourself in a rut. Nevertheless, the website needs a phone number for Truebill; therefore, responses may be delayed.

- Simple to use

They developed the Truebill platform to have a very intuitive user interface. Thanks to its uncomplicated interface, you can browse your bills, subscriptions, and savings with as few clicks as possible, which gives a positive user experience and makes it easy to use.

- Desktop and mobile versions are available.

You won’t have trouble navigating the platform using a desktop computer or a mobile phone. It is important to remember that to access your Truebill account from a desktop computer; you will first need to get started with the mobile app.

Truebill Cons

Listed below are some of the Cons of Truebill:

- Heavy price

Truebill intends to assist you in cutting costs, but doing so comes at a high price in the form of a service charge that is deducted at forty percent from the amount of money you save each month. It is in addition to the price tag on the premium service charges.

Truebill might be another unwelcome automated subscription that eats into your monthly revenue if you aren’t cautious.

- Intrusive ads for free users

Those who have not subscribed to the premium edition of Truebill will be forced to endure obtrusive adverts inside the app itself. While this does not significantly impair the app’s usefulness, you may feel that the advertising takes up too much of your time.

Other Alternative apps of Truebill.

There are plenty of other apps for managing personal finances than Truebill. Look at some of the company’s other rivals.

- Trim

If you compare the features of Trim with Truebill, you’ll find that Trim is the software that most closely resembles Truebill. Bill negotiation is one of the features offered by Trim, along with the ability to cancel unneeded subscriptions and reduce specific payments.

It is predicted that customers of Trim save a total of $620 on average. On the other hand, Trim does not provide a mobile application.

- Simplifi

Simplifi is an app for managing your finances that helps you stay on track with your spending, budgeting, and savings objectives.

It includes seeing all of your financial information in a single location and receiving insights and notifications that will assist you in accomplishing your objectives.

- Digit

The budgeting, saving, and investment objectives that you have may be made more manageable with the assistance of the mobile application known as Digit.

It does this by informing you, in real-time, of the amount of money you have left to spend and by automating various aspects of your financial management. It involves determining how much money you will need to pay your expenses and how much you will need to save.

Is Truebill FDIC-insured?

Indeed, the FDIC protects smart savings accounts offered by Truebill thanks to NBKC and other bank partners of Synapse. Set up these accounts to automatically transfer money into savings at the most convenient periods. The average maximum insurance coverage the FDIC provides is $250 000 per account holder and savings account.

Related Articles:

High Risk Merchant highriskpay.com

Do You Want Your Video in Multiple Languages?

Bottom line

Truebill may provide an inexpensive solution to reduce some of the costs associated with your monthly subscriptions and bills if you believe you have many of these types of expenses. It’s not surprising that Truebill, like other similar apps, charges for its premium capabilities; however, what sets it apart is that users may choose their rates for premium membership and the percentage the software keeps for successfully negotiating lower costs.

It may provide the impression of being more reasonably priced to a more significant number of people. On the other hand, if you are confident in your ability to call your banks and other service providers for your bills and negotiate lower payments on your own, then it might not make sense for you to pay for Truebill to do it for you potentially. It is because Truebill will negotiate lower payments on your behalf.